If you’re buying a home in the Florida Keys, one of the items you’ll see on your closing disclosure is called the “Documentary Stamp Tax.” You might see it on the deed and/or the mortgage, depending on how the deal is structured. As your Realtor, I always make sure you understand exactly what this charge is—and who’s responsible for it.

What Are Documentary Stamps?

Documentary stamp taxes—commonly known as “doc stamps”—are a form of tax assessed by the state of Florida on real estate documents that are executed, recorded, or delivered in the course of a property transfer. There are two main types involved in a typical transaction:

-

Doc stamps on the deed – based on the sale price of the home.

-

Doc stamps on the mortgage – based on the loan amount being borrowed by the buyer.

Who Pays What?

-

Sellers typically pay the doc stamps on the deed in Florida. These are calculated based on the full purchase price of the property and are due at the time of sale.

-

Buyers are generally responsible for paying the doc stamps on the mortgage, if they are financing their purchase.

This is the customary arrangement in Monroe County and throughout most of Florida, although parties can negotiate differently in rare cases.

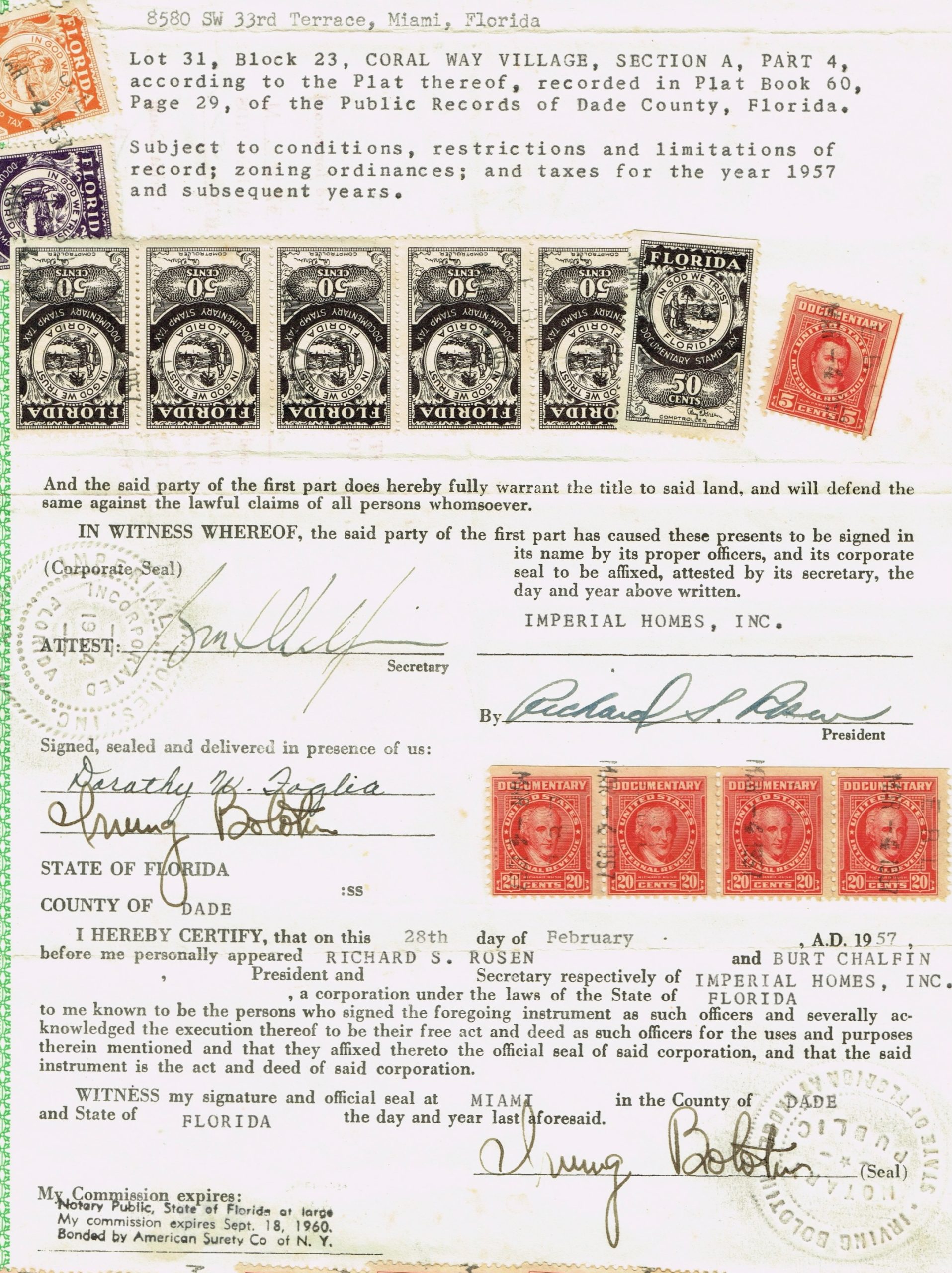

A Quick History Lesson

The term “documentary stamp” comes from an old practice—literal stamps that were affixed to legal documents to show tax had been paid, much like a postage stamp. Florida began using them in the early 1900s, and even though we’ve gone digital, the name has stuck around.

How They’re Calculated in the Florida Keys

Monroe County follows the statewide rate set by Florida law:

-

Doc stamps on the mortgage are charged at 35 cents for every $100 of the loan amount, rounded up to the nearest $100.

So for example, if a buyer takes out a $300,000 mortgage, you divide that amount by 100, which gives you 3,000 taxable units. Then, you multiply those 3,000 units by $0.35, resulting in a total mortgage doc stamp tax of $1,050. -

Doc stamps on the deed, which are typically paid by the seller, are charged at 70 cents for every $100 of the purchase price.

So if the home is sold for $500,000, you divide that by 100 to get 5,000 taxable units. Then multiply 5,000 by $0.70, which equals a total of $3,500 in deed doc stamps.

Why It Matters

Understanding documentary stamp taxes can help you better anticipate your closing costs and avoid surprises. While it’s just one part of the overall transaction, it’s a Florida-specific expense that’s important to factor into your budget—especially if you’re financing your purchase.

If you ever have questions about what taxes apply to your situation—or who is expected to pay what—I’m always here to explain the details and make sure you feel confident heading into closing.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link