Somewhere near the middle to end of 2020, the national housing market went off the charts, and has stayed exceptionally busy for the duration of 2021. From California to Florida, property has been selling at record levels, at times well above list price. This fast pace has been seen in both the luxury and middle class segments of the market.

The biggest group of consumers affected by this? Long term renters.

Buyers were drawn to historically low interest rates and competitive lenders, leading many of them to finally make the jump from renting to owning. Sellers were drawn to higher than ever selling prices and fast sales, which made the idea of selling and cashing out before the market cooled off seem like a sound financial decision.

And in the middle of this perfect storm: Covid.

Suddenly, there was literally no place like home. As lockdowns and quarantines became the norm, people began to look at their homes in a new light. Homes became offices. They became classrooms. They became gyms. And they became places to stay safe from Covid-19. Suddenly, everyone wanted to own a home, and properties started flying off the market.

But as Covid continued to spread, and lockdowns lingered, many people lost their livelihoods, and either paid rents late or stopped altogether because they simply didn’t have the income anymore. The loss of rents, combined with the lure of a quick sale at a good price prompted many sellers to offload their property.

When those rental properties were purchased, the higher sales price necessitates a higher rental price. Homes that were purchased years ago can rent for relatively low price and still make a profit for the owner, but many of these homes recently sold in the market flurry, forcing those tenants to look for a new place to live. But as the cost of purchasing a home rises, the cost of renting one has to rise as well.

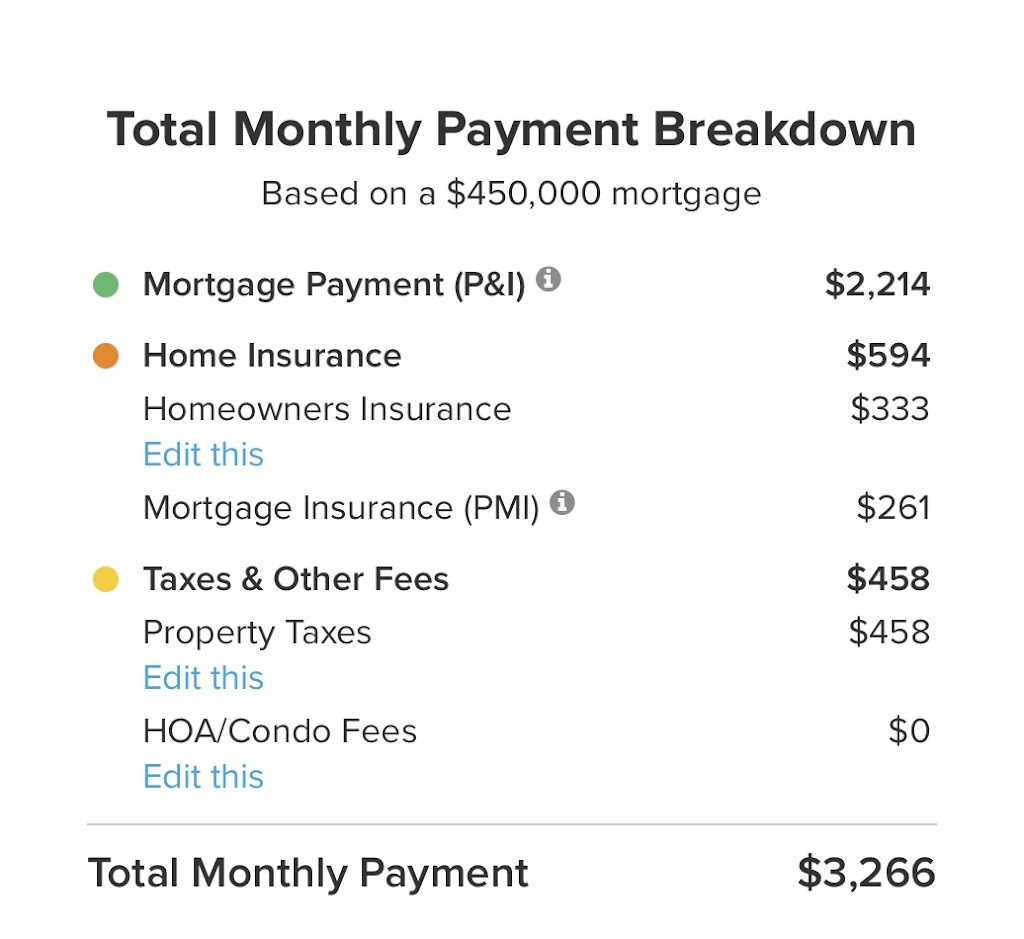

For example, let’s assume an investor could find a home for sale for $500,000. With $50,000 down and a mortgage at 4% interest, the mortgage payment alone is going to be $2214. Add in property taxes and insurance, and the monthly cost of the property is over $3000. When you factor in expenses such as ongoing maintenance and repairs, and you would need to collect at least $3500 just to break even. But here’s the catch: Finding that home under $500,000 isn’t going to be easy. As of this writing, there are only 8 available in the Upper Keys.

The reality is, many Keys locals simply cannot afford $3500 for rent. This means they will either have to leave the Keys, take on roommates, or find better paying jobs, which are few and far between in our island home.

All of this means that the rental picture in the Keys is not an attractive one, and it will probably take some time and some hard adjustments before it corrects, if ever. Recently sold homes with mortgages can’t reduce rental amounts and still break even, and owners that have either had their investments for a long time or don’t have a mortgage don’t want to rent for less than the new higher market rate, making it even harder for people to find a place to live.

More than ever, it is imperative that we address affordable housing in the Florida Keys. Without it, we lose our workforce. And a community simply cannot exist without its workforce.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link